Transform Digital Banking with AI-Powered CRM: Predict, Personalize & Perform at Scale

Why your bank needs an AI-powered CRM? Still Guessing What Your Customer Wants Next?

The Age of Guesswork Is Over

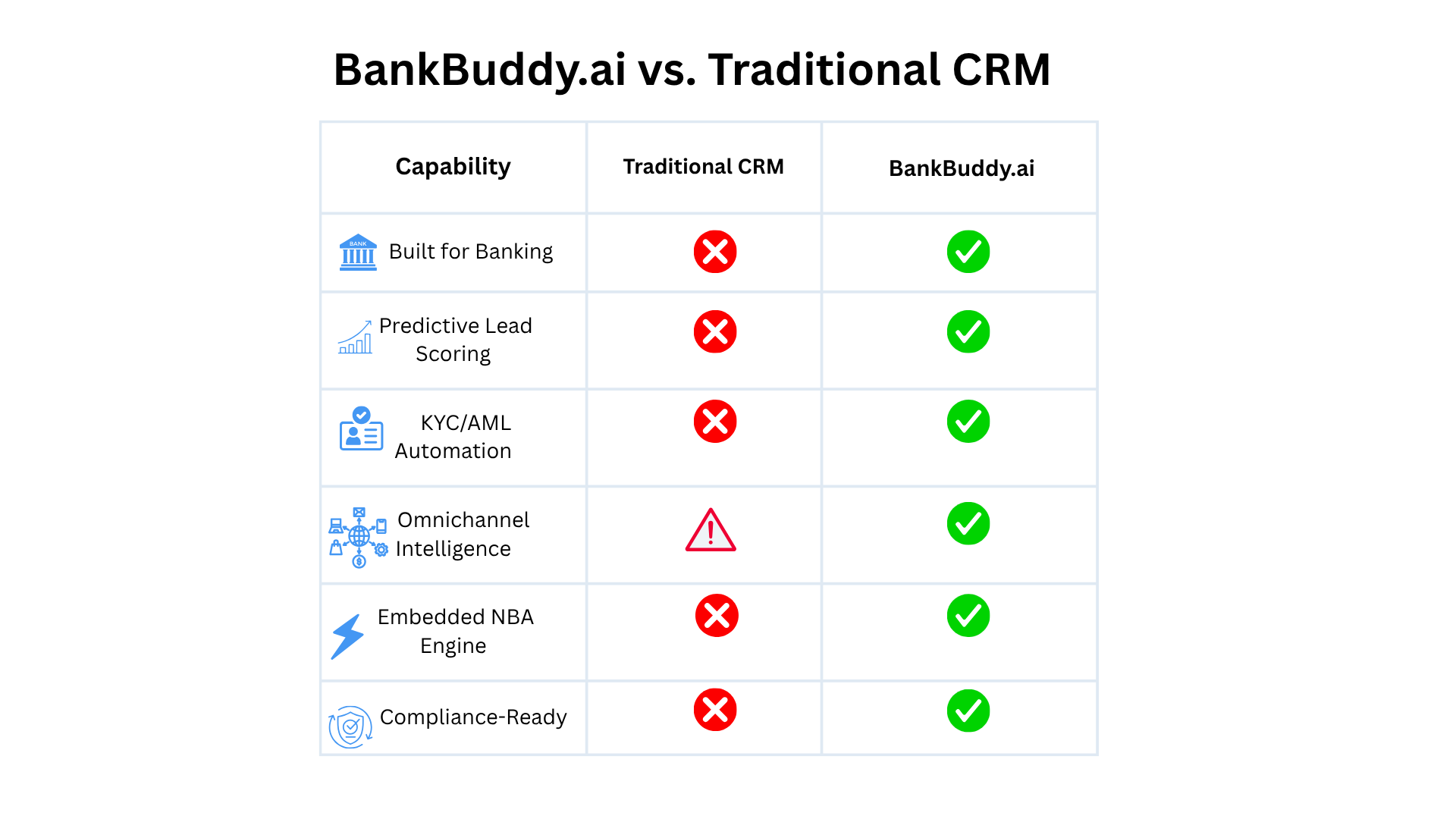

In today’s fast-paced digital economy, banks are expected to deliver not just services, but experiences. Personalized. Predictive. Timely. And yet, most traditional CRMs are ill-equipped for the complexities of banking. They weren’t built for compliance workflows, fragmented data systems, or customer journeys that span everything from WhatsApp to wealth management.

This is where AI-native, banking-specific CRM platforms like BankBuddy.ai are changing the game. Generic CRM just won’t cut it anymore.

According to

Deloitte

, 80% of financial institutions now see CRM systems as core

to their digital transformation. With the CRM market

projected to hit $128 billion by 2025, the competitive edge

is rapidly shifting to those who adopt AI early.

CRM is no longer a digital Rolodex. It’s your bank’s GPS for

growth.

- Centralized Customer Profiles: Unified views with KYC, product history, and communication logs

- Mobile Access: Empower RM teams with real-time data on the go

- Built-in Compliance: Automated tracking for AML, KYC, and regulatory workflows

- Real-Time Dashboards: Monitor customer sentiment, RM activity, and revenue pipelines

- Seamless Integrations: Connects with core banking, marketing, and customer service tools

- Enterprise-Grade Security: Encryption, audit trails, and access control

- Omnichannel Capabilities: WhatsApp, chat, phone, SMS, email, and more

- Embedded AI: Intent detection, behavior modeling, and next best action engines

Not another bolt-on, not a “CRM for everyone,” and definitely not a glorified contact list.

BankBuddy.ai is an AI-native CRM engineered for banks.- Customer 360° View: Unified, real-time view of customer interactions, intent, and product history

- AI-Driven Onboarding: Automates document collection, identity verification, and credit checks

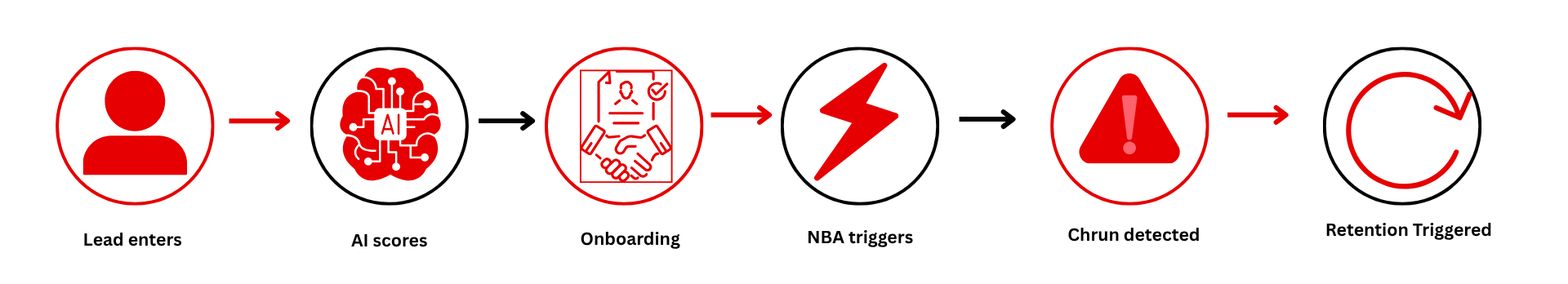

- Smart Lead Management: Intent-based scoring and journey automation

- Next Best Action Engine: LLM-powered recommendations for personalized cross-sell/upsell

- Predictive Retention: Emotion detection and churn risk alerts for timely intervention

- Omnichannel Engagement: From mobile app to WhatsApp to voice—a seamless AI-powered journey

- Compliance Built-In: Global and local regulatory alignment to reduce risk

Know what your customer needs—before they do. Lead scoring and next-best-action recommendations powered by real-time behavior, life events, and transaction signals.

Omnichannel Messaging:WhatsApp, app, email, web—your customer doesn’t care about the channel. They care about continuity. So we give them seamless conversations, not platform ping-pong.

Smart Dashboards:Forget static reports. BankBuddy.ai highlights bottlenecks, drop-offs, upsell triggers, and churn risk in real-time—so you act when it matters.

Unified Customer 360:From KYC to birthdays to behavioral insights, everything’s stitched together into one golden record.

Automated Compliance:AML, KYC, GDPR? It’s built in. No workarounds, no manual triage, no risk.

Onboarding on Autopilot:ID checks, document capture, credit scoring—all in minutes, not days. Say goodbye to clunky handoffs.

Emotion + Churn Detection:We even detect customer sentiment and disengagement patterns—because by the time they complain, it’s often too late.

Conclusion: Ready to Move from Guesswork to Growth?Traditional CRMs weren’t built for the future of banking. BankBuddy.ai is.

-

If you’re ready to:

- Cut onboarding time by up to 40%

- Boost lead conversion by 30%+

- Increase retention and customer lifetime value

- Deliver always-on, intelligent service (BankBuddy)

Then it’s time to see what an AI-native CRM can do for your bank.

Schedule a demo today and reimagine what CRM means for banking growth.