What's in store for WhatsApp banking in 2022 and beyond

Whatsapp banking is now mainstream, and 30% of banks in EMEA and Asia are offering their customers the convenience of an AI-powered Whatsapp banking chatbot.

Let's look at the evolution of WhatsApp banking over the past few years -

The first-generation WhatsApp business API based banking solutions offered a SMS kind of experience with rigid menus, information focus and no Natural Language Processing (NLP), which didn't take off well as the poor UX and lack of relevant functionality did not augur well with the customers.

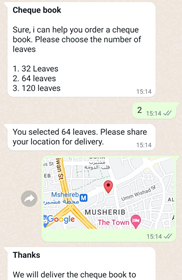

The second-generation WhatsApp banking bots bundled NLP, Visual UX with buttons, images, inline agent handoff, and a bunch of secure transactions with Multi-factor authentication. Customers accepted it as a quick alternative to mobile banking for on-the-go transactions. Moreover, it gave a wallet-like experience and helped banks bring back customers from MVNO/standalone wallets.

Click here to view the video on WhatsApp banking security

The third-generation WhatsApp banking is packed with Intelligence and agility to offer a better than Mobile app experience with clutter-free & personalised interactions in both pull and push formats.

So, let’s look at how WhatsApp banking looks like in 2022 and beyond.

Personalization - The most important feature of WhatsApp banking where every user can have a dynamic experience based on products, time of the month, behaviour, persona, last interaction, etc.

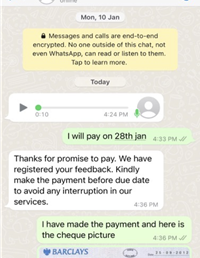

Single Chaining - Combining push and pull messaging for a seamless experience and making WhatsApp banking the single most preferred channel for customers. E.g A person gets a broadcast message for outstanding card payment with the option to pay, and with one click, the payment can be done.

Cognitive Load - A frictionless UX with least steps to complete goal completion on WhatsApp banking channel following Hick’s law of UX design.

Contextual Enquiry - Predictive suggestions based on user behaviour like frequent transactions, products held, etc., intuitively guide the users.

Multilingual NLP - Polyglot NLP gives a human-like experience with slang abbreviations and a mix of languages.

Multi-level security and Authentication - The intent-based mix of authentication via tokens, OTP, MFA etc. with tiers based on transaction amount, behaviour, transaction frequency, beneficiary type, etc. provides frictionless experience e.g., Micro payments upto a limit can be done with long expiry token.

Speech Integration - It enables voice banking on WhatsApp with ASR and TTS for true on-the-go usage.

Exciting times ahead with planned enhancements of WhatsApp business API and wider adoption of WhatsApp as a smart banking channel for customer engagement. Talk to us to jumpstart with Smart 3rd Generation WhatsApp banking.